PM Youth Loan Scheme Online Apply 2025

Starting a business is a big dream for many young persons in Pakistan, and the administration’s loan scheme for youth offers you a real chance. The PM Youth Loan Arrangement for 2025 has important updates, making it easier for you to apply online, access additional funds and get better terms. In this article you’ll find everything from A to Z — what the scheme is, new features for 2025, how suitability works, what leaflets you need, how to apply step-by-step, and how to prosper.

| Programme Name | Start Date | End Date | Amount of Assistance | Method of Application |

|---|---|---|---|---|

| Prime Minister’s Youth Business & Agriculture Loan Scheme (PMYB&ALS) | Ongoing (2025) | Until further notice (as per official portal) | Up to PKR 7.5 million under current tiers; some update‐sources mention up to PKR 10 million | Online submission via official portal |

What is the PM Youth Loan Scheme?

The PM Youth Loan Scheme Online Apply 2025 officially named the Prime Minister’s Youth Business & Agriculture Loan Arrangement (PMYB&ALS) is a administration of Pakistan inventiveness to help young managers and farmers.

It supports both new commercial ventures and existing ones — including agricultural projects. The aim is to reduce youth joblessness, promote self-employment and rouse economic development finished youth-led free enterprise.

Fresh Updates for PM Youth Loan Scheme Online Apply 2025

Here are the key features and updated terms (based on latest available information):

- The application process is fully online via the authorized portal.

- Age eligibility now covers up to 45 years for most candidates; for IT/e-commerce businesses the lower age limit is 18 years.

- Subsidised mark-up rates: Tier 1 (up to PKR 0.5 million) is 0%; Tier 2 (above 0.5m up to 1.5m) ~5%; Tier 3 (above 1.5m up to 7.5m) ~7%.

- The loan limits currently go up to PKR 7.5 million under the official structure. Some newer sources mention “up to PKR 10 million” for 2025 inform but this isn’t yet formally long-established in all bank/SBP documents.

- The tenor (repayment period) has been clarified: for long-term loans up to 8 years with a grace period; for working-capital/production loans up to 5 years.

- Special focus on IT, e-commerce and green commercial sectors, and shares for women businesspersons (e.g., 25% reserved) are said in countless bank companion brochures.

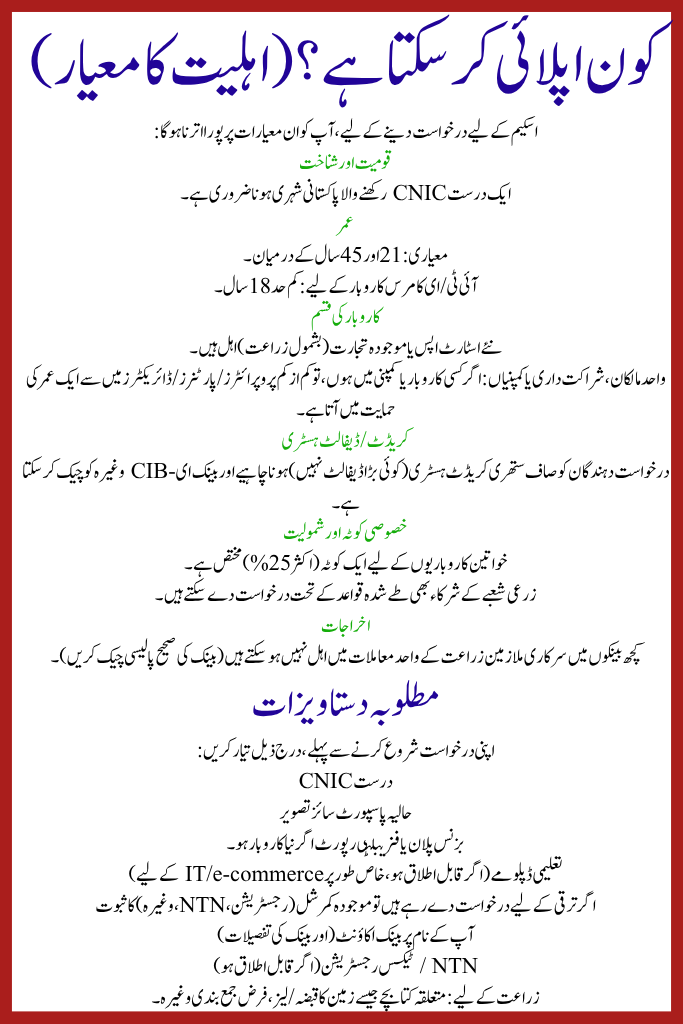

Who Can Apply? (Eligibility Criteria)

To apply for the PM Youth Loan Scheme Online Apply 2025, you must meet these criteria:

Nationality & Identity

- Must be a Pakistani citizen holding a valid CNIC.

Age

- Standard: between 21 and 45 years.

- For IT / e-commerce businesses: lower limit 18 years.

Business Type

- New startups or existing trades (including agriculture) are eligible.

- Sole proprietors, partnerships or companies: if in a business or company, at least one of the proprietors/partners/directors necessity fall in the age support.

Credit / Default History

- Applicants must have clean credit history (no major default) and bank may check e-CIB, etc.

Special Quotas & Inclusion

- There is a quota (often 25%) reserved for women entrepreneurs.

- Agriculture sector participants can also apply under defined rules.

Exclusions

- Government employees in some banks might not be eligible (check the exact bank’s policy) in agriculture singular cases.

Required Documents for PM Youth Loan Scheme Online Apply 2025

Before you begin your application, prepare the following:

- Valid CNIC

- Recent passport-size photograph

- Business plan or feasibility report if new business

- Educational diplomas (if applicable, especially for IT/e-commerce)

- Proof of existing commercial (registration, NTN, etc) if applying for growth

- Bank account in your name (and bank details)

- NTN / tax registration (if applicable)

- For agriculture: relevant leaflets like land possession/lease, Fard Jamabandi etc.

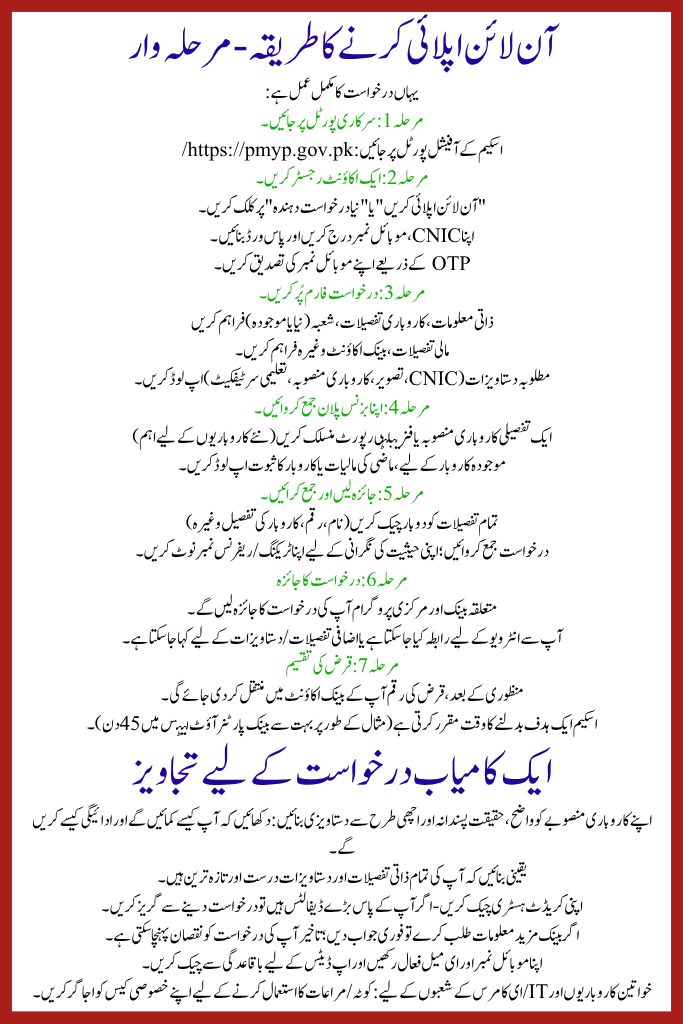

How to Apply Online – Step by Step

Here is the full application process:

Step 1: Visit the Official Portal

Go to the official portal of the scheme: https://pmyp.gov.pk/

Step 2: Register an Account

- Click “Apply Online” or “New Applicant”.

- Enter your CNIC, mobile number and create a password.

- Verify your mobile number via OTP.

Step 3: Fill Out the Application Form

- Provide personal information, business details, sector (new or existing)

- Provide financial details, bank account, etc

- Upload required documents (CNIC, photo, business plan, educational certificates).

Step 4: Submit Your Business Plan

- Attach a detailed business plan or feasibility report (important for new entrepreneurs)

- For existing businesses, upload past financials or proof of business.

Step 5: Review & Submit

- Double-check all details (names, amounts, business description etc)

- Submit the application; note down your tracking/reference number to monitor your status.

Step 6: Application Review

- The relevant bank and the central programme will review your application.

- You may be contacted for an interview or asked for additional details/documentation.

Step 7: Loan Disbursement

- Once approved, the loan amount will be transferred to your bank account.

- The scheme sets a target turnaround time (for example 45 days in many bank partner outlets).

Tips for a Successful Application

- Make your business plan clear, realistic and well-documented: show how you’ll earn and repay.

- Ensure all your personal details and documents are correct and up to date.

- Check your credit history — avoid applying if you have major defaults.

- Respond promptly if the bank asks for more information; delays may hurt your application.

- Keep your mobile number and email active and check regularly for updates.

- For women entrepreneurs and IT/e-commerce sectors: highlight your special case to make use of quotas/incentives.

Conclusion

The PM Youth Loan Scheme Online Apply 2025 is a robust chance for Pakistani childhood to start or expand a commercial with government-backed provision. With online request, subsidised mark-up, clear aptness and decent amounts of funding, it is one of the best administration programmes for young businesspersons today. If you’re qualified and serious about your commercial plan, make your leaflets, list, smear and shadow up — this might be the start of somewhat big for you.

Frequently Asked Questions

Who can apply for the scheme?

How do I apply online?

What are the loan limits for the scheme?

How long does it take to receive the loan after approval?

Is there any special quota for women applicants?

Related Posts