EOBI Pension For Old Citizens 2025

The pension provided by EOBI is a vital social-security benefit for superannuated labors in Pakistan. For old countries seeking financial support from EOBI in 2025, knowing how to claim EOBI pension and what the latest rules are is essential. This guide stretches you the full process, eligibility criteria, obligatory leaflets, recent increases and reforms, request steps, benefits, and shared queries in one place—so after reading this, you must not need to search anywhere else.

Quick Facts Table for EOBI Pension For Old Citizens 2025

| Programme | Start Date | End Date | Amount of Assistance | Method of Application |

|---|---|---|---|---|

| EOBI Old-Age Pension (2025) | Applies ongoing from Jan 1, 2025 reforms | Until further change by govt | Minimum pension increased to Rs 11,500/month and other pensions get ~15% hike. | Application: Download form + submit at EOBI regional office or online portal. |

What is EOBI Pension?

The Employees’ Old-Age Benefits Institution (EOBI) is a administration body in Pakistan shaped under the EOBI Act 1976. It provides monthly annuities to eligible superannuated staffs (and other annuities like unsoundness or stayers) who contributed throughout their working years. The old-age income is one of its primary benefits.

The aim is to give financial stability and support after superannuation, particularly for private-sector labors whose bosses were listed with EOBI.

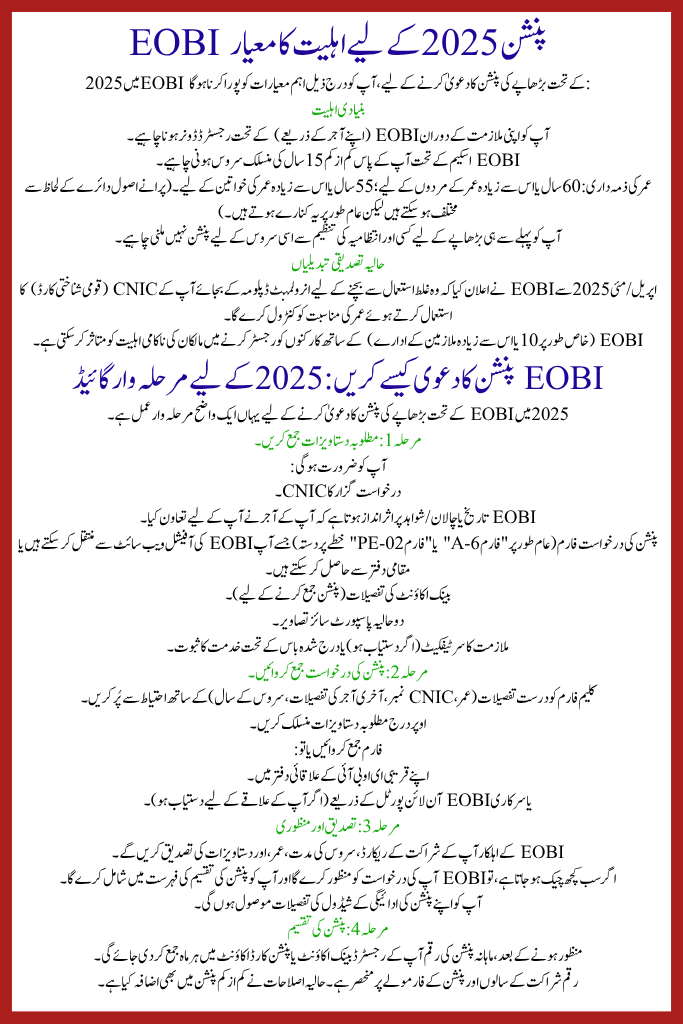

Eligibility Criteria for EOBI Pension 2025

To claim the old-age pension under EOBI in 2025, you must meet the following major criteria:

Basic eligibility

- You must have been a registered donor under EOBI (via your employer) during your employment.

- You must have at least 15 years of connected service under EOBI scheme.

- Age obligation: for men age 60 years or above; for women age 55 years or above. (Older rules may differ by sphere but generally these are the verges.)

- You should not be already receiving a pension for the same service from another administration organization for old-age.

Recent verification changes

- From April/May 2025 EOBI proclaimed it will control age suitability using your CNIC (National Identity Card) rather than enrollment diploma to avoid misuse.

- Failure of bosses to register workers with EOBI (particularly establishments of 10 or more employees) may affect eligibility.

How to Claim EOBI Pension: Step-by-Step Guide for 2025

Here is a clear step-by-step process to claim the old-age pension under EOBI Pension For Old Citizens 2025.

Step 1: Gather Required Documents

You will need:

- CNIC of the applicant.

- EOBI influence history or challans/evidence that your employer contributed for you.

- Pension request form (commonly “Form A-6” or “Form PE-02” contingent on region) which you can transfer from the EOBI official website or obtain from a local office.

- Bank account details (for the pension to be deposited).

- Two recent passport-size photographs.

- Employment certificate (if available) or proof of service under listed boss.

Step 2: Submit Pension Application

- Fill the claim form carefully with accurate details (age, CNIC number, last employer details, years of service).

- Attach the required documents listed above.

- Submit the form either:

- At your nearest EOBI regional office.

- Or through the official EOBI online portal (if available for your region).

Step 3: Verification and Approval

- EOBI officials will check your contribution records, service period, age, and verify documentation.

- If everything checks out, EOBI will approve your application and include you in their pension-disbursement list.

- You will receive details of your pension payment schedule.

Step 4: Pension Disbursement

- Once approved, the monthly pension amount will be deposited into your registered bank account or pension-card account each month.

- The amount depends on years of contribution and the pension formula. Recent reforms have also raised the minimum and increased pensions.

Recent Changes & Benefits for Old Citizens in 2025

Pension Increase

- The federal cabinet approved a 15% increase in EOBI pensions, effective from January 1, 2025.

- The minimum pension was raised from Rs 10,000 to Rs 11,500 per month.

- A new pension formula is being introduced where pension amount is linked more directly to contribution amount and years of service. Under that formula the maximum pension has been indicated as Rs 30,000 per month for long-service contributors.

Expanded Coverage

- EOBI is moving toward including informal sector workers (e.g., domestic workers, agricultural labourers) though full coverage is not yet in place.

Verification Matters

- Use of CNIC age verification is now mandatory to reduce fraud and ensure only eligible persons get pensions.

What Are the Benefits of EOBI Pension for Old Citizens?

- Financial security: You receive a steady monthly income after retirement, helping cover living costs.

- Support based on service: The more years you contributed, the higher your pension will be (under the new formula).

- Regular payments: Once approved, pension is disbursed monthly.

- Institutional framework: A formal system backed by law (EOBI Act) gives assurance to registered workers.

Important Tips to Keep in Mind

- Make sure your employer had registered you under EOBI and made all required contributions while you were working.

- Keep a personal copy of your contribution records or challans—this will help with verification.

- Update your bank account and contact details with EOBI so there is no delay in receiving pension.

- Submit your application well before you turn retirement age (60 for men, 55 for women) to avoid delay.

- Always check the official EOBI website (www.eobi.gov.pk) for any changes or updates to the process.

- Follow up if your application is delayed—sometimes backlog or verification issues cause delays.

- Save all documents and correspondence, in case there are queries later.

FAQs About EOBI Pension For Old Citizens

How long does it take to get pension after applying?

What if I don’t have full 15 years of contributions?

Is there an online way to apply for EOBI pension?

Can pension be claimed by family members after the pensioner’s death?

Conclusion

Applying for the EOBI Pension For Old Citizens 2025 is frank if you meet the suitability criteria, gather the right leaflets, and follow the application procedure carefully. The reforms introduced—such as the 15% income increase, the minimum pension being raised to Rs 11,500/month, and better confirmation—make this an appropriate time to claim the benefit you merit.

By preparing your leaflets ahead, verifying your influence history, applying early, and custody track of your bank details and interaction info, you can secure your retirement revenue easily. For any specific queries or updates, always refer to the official EOBI website or your nearest EOBI regional office.

Related Posts